I’m not a believer that a bad economy means more fraud is occurring. Those who say this is happening simply have no basis for that opinion. Because so much financial fraud goes undetected, it is impossible to determine if it’s growing or not. (But saying fraud goes up in a bad economy makes good sound bytes!)

What I believe is happening is that the occurence of fraud is stable, but more frauds are being discovered because of the economy. The intertwined industries of real estate and construction illustrate this… During good times, it was easy for real estate developers to essentially run mini Ponzi schemes, because there was always a new construction project around the corner to provide new cash to finish up old projects. When the real estate market dried up, the Ponzis fell apart because there was no new cash.

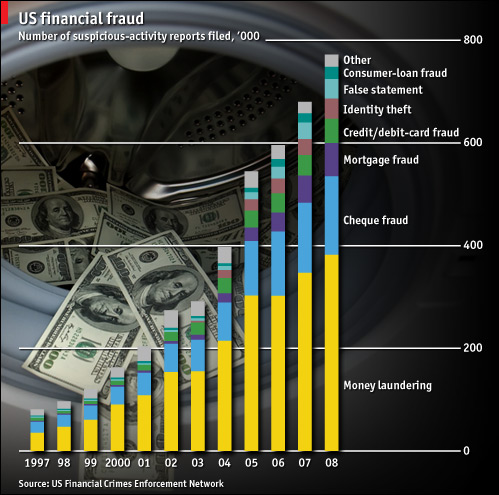

The below chart from The Economist, however, does provide some interesting insight into the issue.

So is more fraud happening or is more fraud just being reported to the authorities? I suspect the latter.

Let me go on record that I’m not a fan of the “Suspicious Activity Reports” that were responsible for the statistics in the above chart. But at least if our government is going to invade our privacy, we can make some use of the data.

I’m not so sure that the economy doesn’t push more brokers and/or investment advisors into fraudulent practices. When revenue from regular security sales (ie, stocks and bonds) is down, many salespeople find the alternative investments, which pay much higher commissions, to be very attractive. Various annuities, collateralized debt obligations and private placements are unbelievably complex, but pay tremendous commissions. Our experience prosecuting claims demonstrates that the brokers tend to ask a lot of questions about the commissions to be paid, but not a lot about how the products work. Accordingly, they don’t understand the products they’re selling and therefore can’t (and don’t) explain them to the customers. The brokerage firms rely on the same defense: you knew what you were buying. Yet it is easy to demonstrate that products such as collateralized debt obligations are understood only by PhD economists, not customers.

Another problem that will become evident in the next few years is the rampant unsuitable annuity sales that took place in the wake of financial apocalypse. Investors were fleeing to “safety,” without understanding what was or wasn’t actually safe. Annuities, with high expense ratios and low liquidity, were touted as “no lose” investments. Such products typically charge massive premiums to gain access to the investor’s principal – sometimes as much as 20%. The products also tend to underperform the market thanks to high expense ratios. Had full disclosure been made, the sales would not have. Thus – fraud.

While I agree that the down market exposes the frauds, the down market also creates more opportunities for unscrupulous brokers and investment advisors.