I’ve written previously about the bankruptcy of Jennifer “MckMama” McKinney and her husband Israel McKinney of Kieran’s Contracting. Jennifer was once a popular mommy blogger at mycharmingkids.net and mckmama.com.

Jennifer Howe Sauls McKinney has a colorful history of lying to the internets about all sorts of things, most notably her debts and her alleged repayment of said debts. You can read here all about how she lied about having paid the overdue taxes owed to the Internal Revenue Service, and other ways that Jennifer was caught red-handed.

Following a very damaging creditors’ meeting in which MckMama was caught in her lies, trustee Gene Doeling initiated an action in bankruptcy court to deny the bankruptcy and take possession of assets that were not disclosed by the McKinneys in their bankruptcy filings.

Israel and Jennifer McKinney never filed a response to the allegations of the trustee, suggesting to me that Mr. Doeling was right on the money with his accusations. Pun intended. One of the assets Mr. Doeling was asking the court to allow him to confiscate and sell (in order to pay creditors) was MckMama’s blog, My Charming Kids. That little piece of internet real estate was believed to have substantial value based on the amount of traffic the site got.

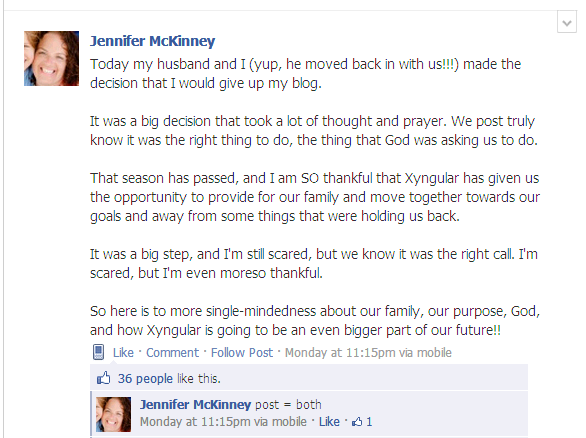

On September 24th, Jennifer McKinney made the big announcement that she was closing her blog:

On one hand, this is a decision that’s been a long time coming. On another, it’s not. I always knew I wouldn’t blog forever. But how would I stop? When? How will I know? But now, this month, today, this week….well, the timing right now just seems perfect. Utterly perfect. Too perfect to pass up, actually. So my husband and I decided that it’s time.

Except the McKinneys didn’t really “decide” to divest themselves of the MckMama website. The bankruptcy court intended to take it it, but Jennifer McKinney could never come clean to her readers. She had to make it seem as if everything was rosy and this was her choice:

And this blog? We just don’t see it in our future. We look into the days, months and years to come and we see a lot of things. But my blog? It’s not there. In its place are other things. More peace, togetherness, stillness and serenity. More love, adventures, excitement and maybe more children. More God, solitude, privacy and security.

Of course, Jennifer is going to focus on her multi-level marketing “business” with Xyngular instead of blogging:

So the happenings in the bankruptcy and the denial of discharge proceeding carry on, and MckMama’s readers are none the wiser. It hasn’t occurred to many of them that Jennifer is just as active with Facebook, Twitter, and Instagram (if not moreso) than she was with her blog. There is no real change in her trainwreck of a life… still the same obsession with attention whoring on the internet while lying about her life.

The only difference is the blog is gone for reasons related to lies the McKinneys told in trying to ditch out of $725,000 in debts they incurred while being reckless spenders. I don’t believe for one minute that Jennifer is done blogging, and sources state that a new blog has been established and will have its live debut soon. This appears to be a very carefully planned segue to a new blog, with no apparent ties to the old blog, so the naughty old bankruptcy trustee can’t possibly lay claim to this asset that didn’t exist at the time the bankruptcy was filed.

This week the clerk of the bankruptcy court filed a notice for all creditors of Jennifer McKinney, Israel McKinney, and Kieran’s Contracting. It’s time to line up to get their share of the proceeds of the confiscation and sale of the McKinney’s assets. Had the McKinneys been honest in their bankruptcy filing, nearly all of their assets would have been exempt, meaning they could not have been taken for the benefit of their creditors. However, because they failed to disclose certain assets and were dishonest in their disclosures, the trustee has sought to take possession of those assets and use them to pay creditors.

Each creditor will likely get pennies on the dollar. But if things go the way they should, the bankruptcy of the McKinneys will be denied, and they will be saddled with these debts into infinity. The creditors can continue to pursue Jennifer McKinney and Israel McKinney for what they are owed. The creditors can garnish wages and levy bank accounts until the debts are satisfied.

For once, it appears that the system may truly work, and dishonest people will be held to account and made to pay. And that, my friends, is a wonderful season.

13 Comments

Leave a Reply

Great article! Thanks for the update. Here’s hoping some of the creditors will get what’s due to them.

I hope you are right Tracy. These two deserve everything that the courts have in their power to send their way. The thing that makes me most irate is that these two HAD THE MONEY to serve their debts but didn’t. The debts were accrued as a result of extravagance & overindulgence. Had they been accrued due to medical reasons etc. Icould be more understanding.

We sit & wait. And hope.

Another great article. Thanks.

Curious though if the income from Xyngular can be garnished in any way? Or can she continue to operate on a mostly cash basis (input and output) and avoid having any money taken to satisfy debts?

Yes, Laura, it absolutely can. When Jennifer gets back into blogging, her advertising revenue can be garnished too. She may think her money is untouchable because its not “wages” from a regular job. That’s just not true. And if some money gets into her grubby little hands, the creditors can swipe it out of her bank account.

It will take some work for the creditors to get paid, but they will indeed get paid.

It would be in everyone’s best interest to settle these debts. The creditors take a haircut on what they’re owed, in exchange for Jennifer voluntarily paying an agreed upon amount. She will think she’s clever and she’ll talk about how she is doing the right thing and paying the old fashioned way… but we know the truth. They gotcha Jen. No abusing the bankruptcy court to escape from your debt.

I seem to remember reading that Xyng offered to make at least some of its payments via gift cards instead of in cash. This strikes me as a particularly underhanded tactic, although it’s not surprising because what else is a multi-level marketing company known for if not underhanded tactics?

But in paying its sales force via gift card, it certainly makes it more difficult for the cash flow to be tracked for tax purposes, and also for garnishment.

Not necessarily so. I believe the garnishment would go to Xyngular directly, and they would be responsible to garnish BEFORE any payment to Jennifer. 🙂

I believe the Mckmama facebook fan page (the fan page, not her personal facebook) should be seized as an undisclosed asset too. She owned that before the bankruptcy was declared, and she did not list it as an asset, and it’s clearly CLEARLY making her money.

Great job as usual Tracy! Thank you for explaining the latest BK paperwork in an easy to understand fashion!

[…] to pay her a visit, or, if you prefer, click this link to go directly to the new MckMama article: http://www.sequenceinc.com/fraudfiles/2012/10/creditors-line-up-in-the-mckinney-bankruptcy/ I love how under MckMama’s photo she called her (morally) bankrupt. How […]

Are there any legal ramifications for the McKinneys or do they just have a large bill to pay? It seems that taking $750,000 worth of stuff and not paying for it would be a crime.

We don’t know yet. Criminal charges for bankruptcy fraud are possible. Charges for theft or fraud at a local level are unlikely because it is so rare for creditors to push the issue. However, I HAVE seen it happen… with creditors making the case that the debtor took money and/or property with the intention of not paying for it, and then indeed keeping the money and property but never paying for it. This is pretty rare, though.

Our best hope is that there are criminal charges for bankruptcy fraud.

Wow. That’s pretty astonishing. If I shoved a few bottles of nail polish in my purse at Target, and walked out the door, they’d call the police and I’d be in huge trouble. It seems that if you shove $8,000 worth of stuff in your cart at Target, and promise to pay for it, you should be in huge trouble when you don’t.

Thanks for the great info and updates Tracy. There’s a new posting on Pacer that refers to a waiver of discharge and it looks like the bankruptcy has been denied. It also says they cannot file bankruptcy for another year and that they cannot file for the debts listed in this bankruptcy petition. Do you think this is the end of it or do you think there will be further steps taken against them as far as assets being seized, etc.? Thanks!