It is common for divorcing spouses to cash out retirement funds at divorce time. And it seems to make sense at the time. There are expensive lawyers and all sorts of expenses to establish a new residence. Support payments may be delayed or non-existent. A retirement fund seems like great solution. It’s a pile of money that you weren’t going to use for a long time, and you have financial needs now.

It is common for divorcing spouses to cash out retirement funds at divorce time. And it seems to make sense at the time. There are expensive lawyers and all sorts of expenses to establish a new residence. Support payments may be delayed or non-existent. A retirement fund seems like great solution. It’s a pile of money that you weren’t going to use for a long time, and you have financial needs now.

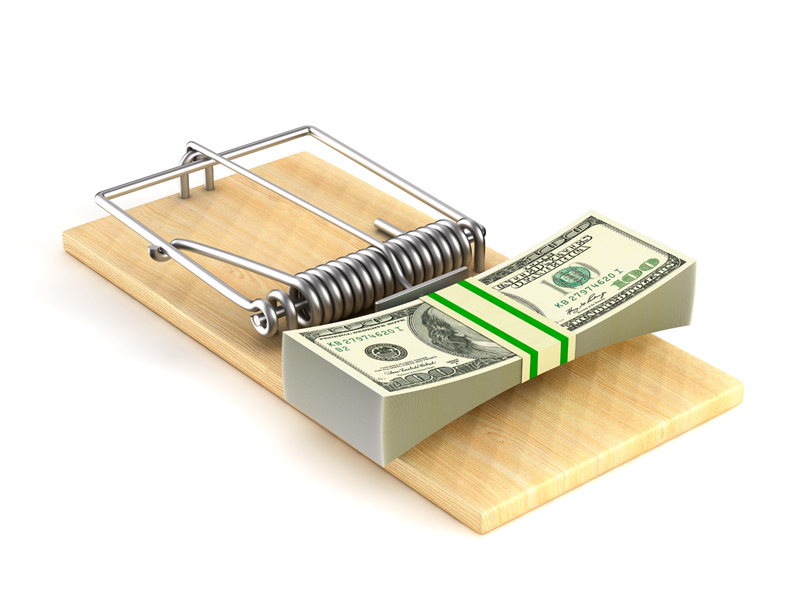

But it should be the absolute last resort, because it’s so costly in both the short term and long term.

Retirement accounts like 401(k)s and IRAs create a tax deduction now (when money is contributed to it), and then taxes are paid when the funds are withdrawn at retirement time. The government wants us to keep the money in those accounts until we retire, so there are disincentives to withdraw the money early. If you take an early distribution from a retirement account, you’re going to pay income taxes on the money you withdraw, plus a 10% federal penalty for early withdrawal, plus any penalties your state may impose. I tell people to count on losing about 50% of the money they withdraw to taxes and penalties.

It is possible to do other types of withdrawals, such as a loan from your 401(k) or a hardship distribution. Just remember that your definition of “hardship” may not be the same a the government’s definition.

But even if you are able to take money out of your retirement account without the tax or penalty problems, should you? It’s sometimes easy to ignore the long term impact of taking money out of your account. You need to think about the fact that taking money out today will severely impact you when you retire 20 or 30 years from now. If that money had remained in the account, the earnings over the years would have been substantial. You may be jeopardizing your financial security in retirement.

My advice is to make any sort of withdrawal from a retirement account only if there are absolutely no other options. If you can’t borrow money, get a second job temporarily, cut your living expenses, or find some other creative way to make the finances work and you’re in danger of being on the street or going hungry, then consider it. Otherwise, do whatever you can to avoid early withdrawals from your 401(k), IRA, or other retirement account.